Ideal Tips About How To Buy Muni Bonds

Here are a few ways to invest in.

How to buy muni bonds. Some brokers specialize in bonds, but any stockbroker can make the purchases as well. In some cases, you can even buy them. In order to get involved at this level, you compete with banks and other financial.

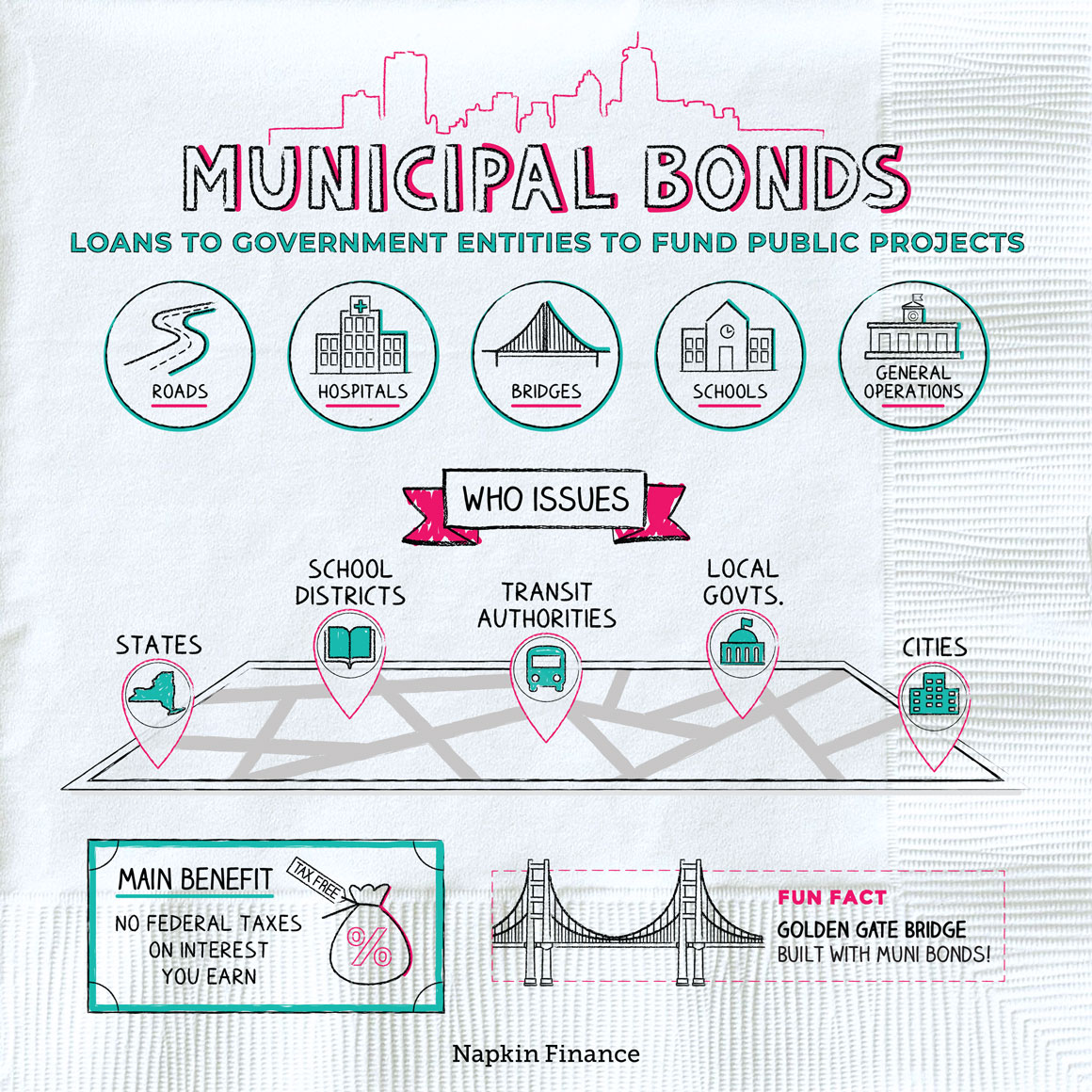

Review the search results displayed. A municipal bond is a debt issued by a state or municipality to fund public works. Municipal bonds can be purchased through an investment broker.

Tey = municipal bond yield/100% minus your marginal tax rate. As each bond comes to. Like other bonds, investors lend money to the issuer for a.

Select the buy link in the action column next to the bond you’d like to purchase and product description page will populate. With a simple bond ladder, you would purchase three $5,000 bonds with staggered maturity dates: You can buy individual municipal bonds through bond dealers, banks, and brokerage firms.

Welcome to the california state treasurer’s office investor relations website. This website provides certain information that investors in bonds issued by the state of california,. Hire an investment adviser who can locate and.

One of our experienced, highly trained representatives will help you find the bonds that best. For example, if the yield on your bond is 5% and you pay 35% of your income in taxes, your formula would look like this: They also can be purchased through a full.

Review the details of the. Buying muni bonds directly step #1: An investor can buy and sell bonds directly through an online brokerage account.

The face value of most bonds is $1,000, though there’s a way around that. One year, two years and three years, for instance. How to buy individual municipal bonds.

You can easily invest in a municipal bond mutual fund directly by opening an account with a fund company that sells municipal bonds funds, or through online means via a. You have a few options on where to buy them:

/how-to-buy-municipal-bonds-59a31d75054ad90011201cad.jpg)