Top Notch Tips About How To Buy National Savings Certificate Online

Premium bonds application form for yourself or your child under 16.

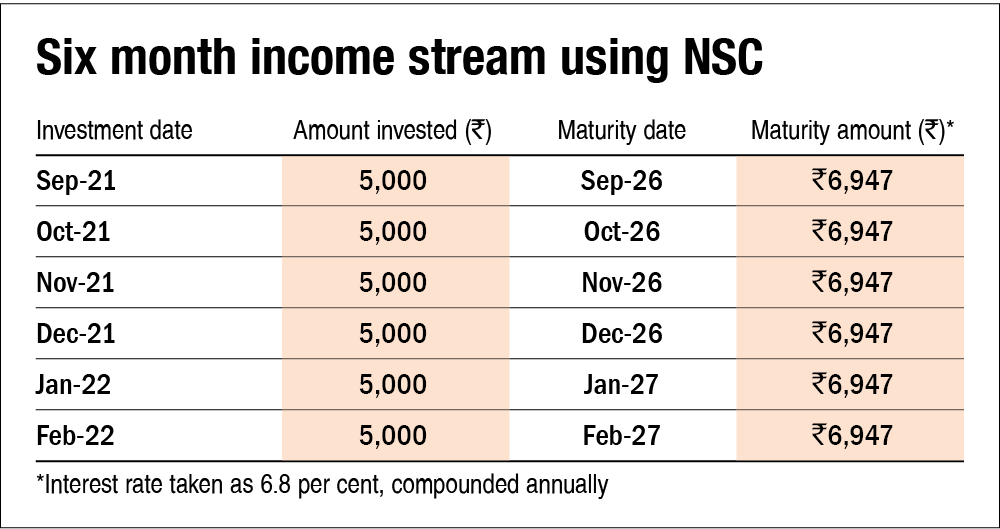

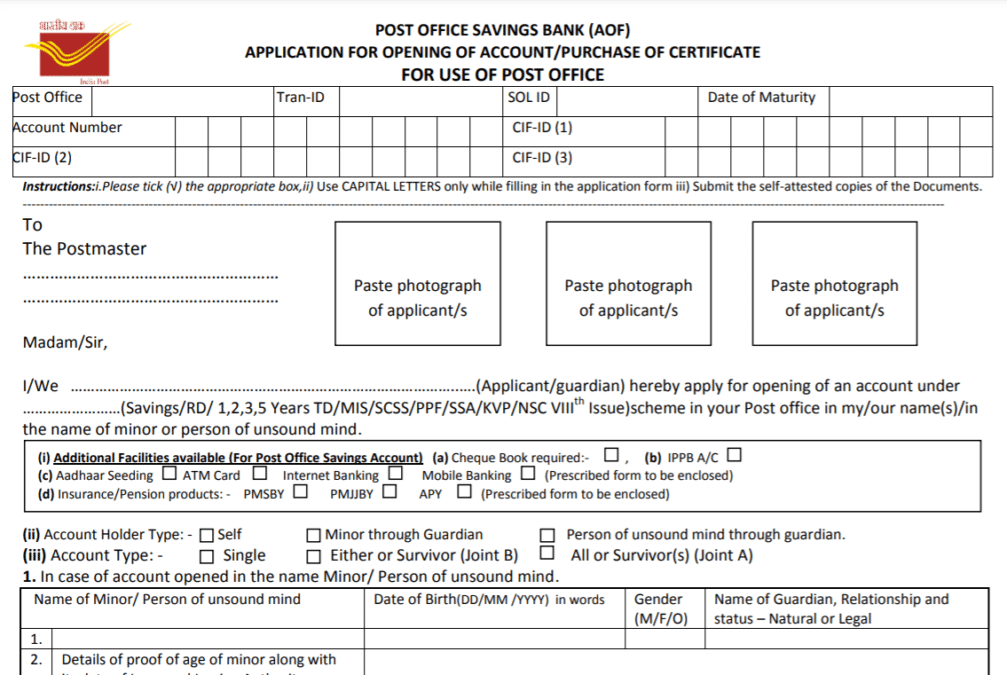

How to buy national savings certificate online. The national saving certificate is issued by the government of india. Just key in the amount of money invested and the rate of interest (6.8% at present) and the calculator will show the maturity value of an nsc after five years. First, visit the post office branch where you have opened the national savings certificate scheme.

Minimum €50 up to maximum €120,000 per individual per issue. ₹ 1,12,500 + 30% of total income exceeding ₹ 10 lakh. The national savings certificate can be purchased at a post office or authorized banks.

Register, view and manage your holdings online with state savings online. Minimum amount for opening of. Text size a a a.

The officer will give you a form. Premium bonds application form as a gift for someone else’s child. Color c c c c.

National savings monthly income account (mis) post office monthly income scheme account (mis) interest payable, rates, periodicity etc. You can cash in at the end of a term with no penalty or. Fixed interest savings certificates are designed to be held for the whole of your chosen investment term.

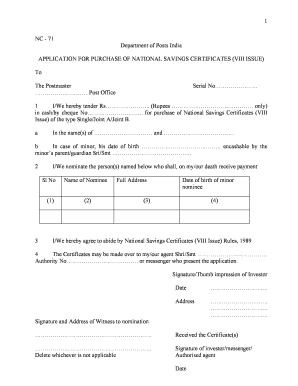

Go to the help desk and ask the officer about account opening procedures. The purchaser has to fill form 1 and submit it to the post office or bank along with. 5% of total income exceeding ₹ 2.5 lakh.

Below are the guidelines for opting the certificates in electronic form; Fill up the form and handover it to the nsc. Access to your initial investment and any interest.

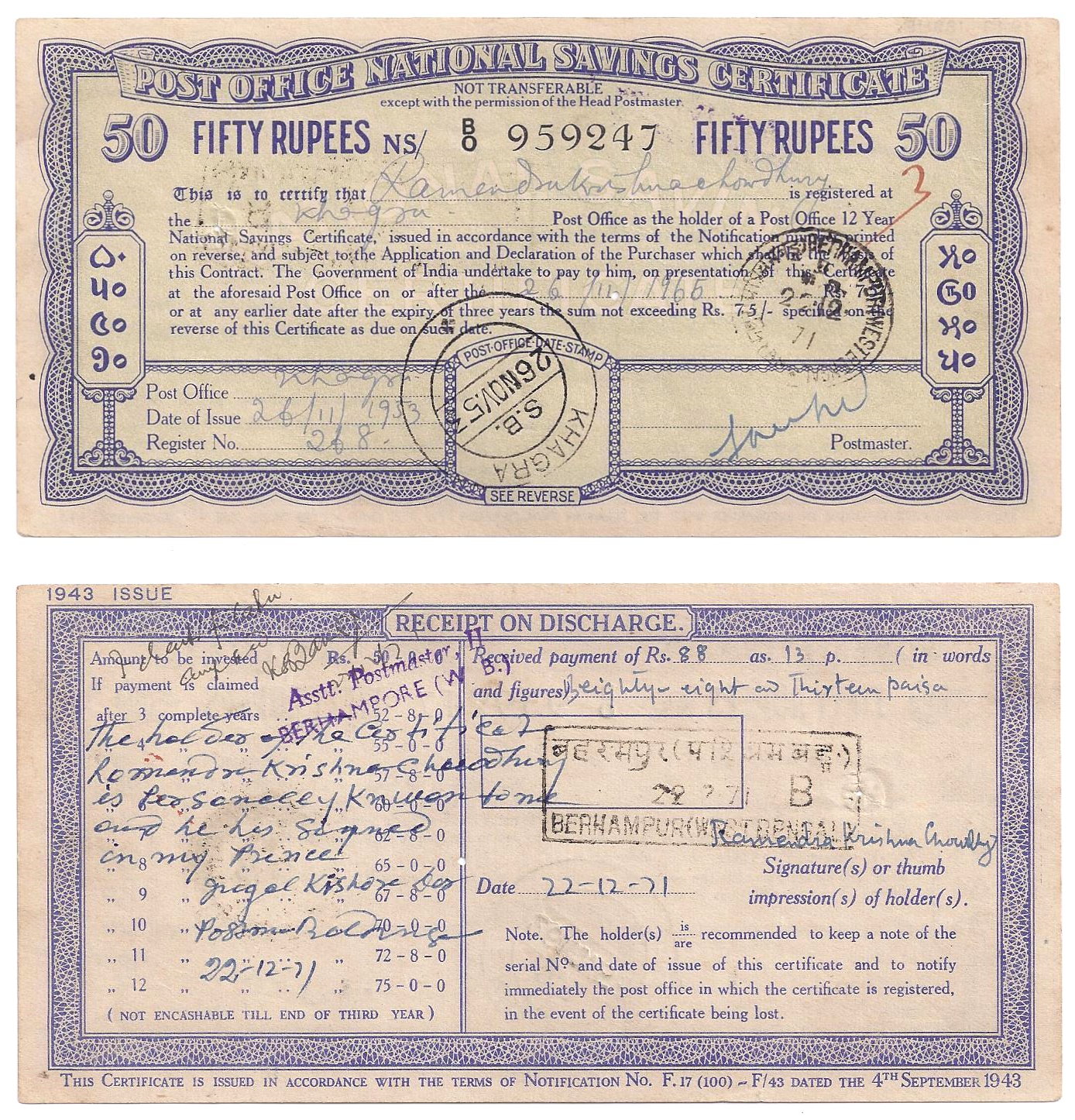

Nsc certificates can be issued through electronic mode or in passbook mode. ₹ 12,500 + 20% of total income exceeding ₹ 5 lakh.

.png)