Looking Good Info About How To Check National Insurance Contributions

There may be a reason why you cannot check your national insurance contributions record online.

How to check national insurance contributions. New business, duplicate) original and photocopy of certificate of incorporation (new business). The payment of national insurance contributions is compulsory for employees and unpaid apprentices who are registered or eligible to be registered under the system. Class 1 national insurance rate.

Applying for a national insurance statement. You need a national insurance number before you can start paying national insurance contributions. 15 th april of the same year.

It’s easy to sign up and can be done online. You can check your national insurance record online to see: You pay mandatory national insurance if you are 16 or over and are.

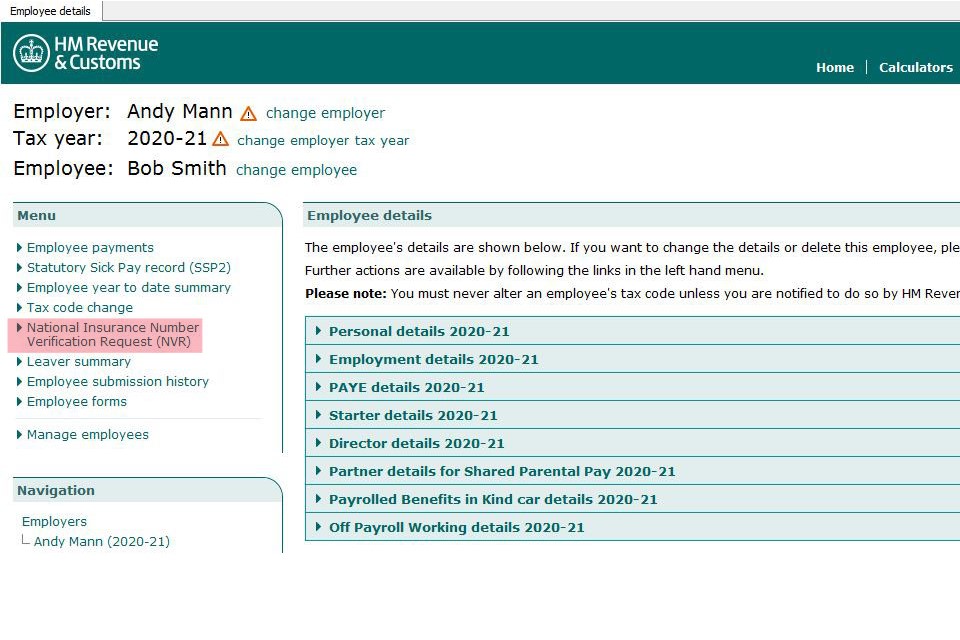

Primary class 1 national insurance contribution (nic) the primary class 1 national insurance contribution (nic) is payable by the employees if their earnings exceed the. You will get to the screen below. What you’ve paid, up to the start of the current tax year (6 april 2022) any national insurance credits you’ve received.

Filling in the online form and posting it to us, if you’re unable to register for a personal tax account. Every individual making national insurance contributions should ensure their contributions are up to date. How do i check gaps in my national insurance records?

If you really can't find it you can fill out. On letters about your tax, pension or benefits; Your national insurance number will be on payslips, p60s, and letters concerning tax and benefits.

You may still get a qualifying year if you earn between £123 and £242 a week from one. You can find your national insurance number: You might not pay national insurance contributions because you’re earning less than £242 a week.

National insurance remittance card (payment card) employer’s registration form (n.b. If so, you can request a printed national. You can check the record of how much national insurance you have paid online, on the gov uk website (under the national insurance section).

You can check your national insurance contribution record by following this link. In the national insurance section of your personal tax account Those earning £242 per week pay class 1 contributions, deducted automatically by your employer.

Registering and logging into your personal tax account to view a letter with it on. You will need to sign in using a government. The 2021 annual report was laid in the house of representatives on february 11, 2022.